The Company & Who We Serve

The company has been in business since 1996 and has helped businesses identify $37B+ to date in specialized tax incentives (ERC, WOTC, PPP and more) with zero IRS disallowances. These tax incentives have been around for decades, yet only 10% of companies take advantage of them.

It is the national leader in specialized tax incentives for businesses, with award-winning, proprietary software that identifies and claims tax credits for clients. The company’s team includes engineers, IP attorneys, and tax specialists.

Virtually all businesses have specialized tax incentives that they may be entitled to – this link provides an overview and includes an online calculator that, in about 2 minutes, informs you of the tax credits you can expect for your business. Alternatively, you can feel free to book a 10 minute, no obligation call here with a member of our team.

Benefits to Your Business

These are the primary tax credits that we are helping businesses take full advantage of:

- Cost Segregation Tax Credit

- For any business that owns commercial property or has renovated its leased commercial property.

- Allows businesses that have constructed, purchased, expanded or remodeled any kind of real estate to increase cash flow by accelerating depreciation deductions to offset tax liability.

- Our proprietary software breaks down all of the components of the commercial property that the IRS allows in order to find applicable tax credits.

- Workers Opportunity Tax Credit (WOTC)

- This federal tax credit is available to any employer hiring individuals from target groups designated by the federal government. 23% of all hired candidates will qualify for this tax credit and it is an excellent tax credit for employers who regularly hire employees with high turnover (e.g. construction, restaurants, hospitals, auto dealers, etc.).

- Tax credits average $2,400 to $9,600 per employee. WOTC is a general business credit that is applied against income on your tax return.

- The system incorporates a predictive model that helps employers determine which candidates will qualify for the highest WOTC tax credits.

- Research & Development (R&D) Tax Credit

- This is a payroll credit for businesses (manufacturers, software, start-ups and many others) that devote time and resources to creating new or improving existing products, processes or techniques. It is an excellent tax credit for businesses with Qualified Research Expenditures (QREs). Typical hires include designers, engineers, IT specialists, and scientists.

- This tax credit has been available since 1981, with increasingly broader application to businesses.

- It is a federal tax credit that allows companies to reduce income tax liability and receive a cash refund for taxes paid in their previous 3 years. It is a dollar-for-dollar tax credit. Unused credits can be carried back 1 year and forwarded up to 20 years.

- An evaluation is performed and a full report is provided for claiming this tax credit.

- Disaster Employee Retention Credit (ERC)

- This tax credit has been available since 2017 and includes COVID. It applies to any business that operated in a qualified disaster zone and became inoperable due to the disaster.

- It is a refundable tax credit against employment taxes, with an average credit per employee of $2,400. Credits exceeding liability are treated as an overpayment and refunded back to the employer.

- COVID ERC

- This tax credit applies to any employer that retained its workforce and whose revenues were impacted by COVID-19 during 2020 and 2021.

- It is a refundable tax credit against employment taxes. The benefit for 2020 is $5,000 per employee. For 2021, it is $21,000 per employee. Credits exceeding liability are treated as an overpayment and refunded to the employer.

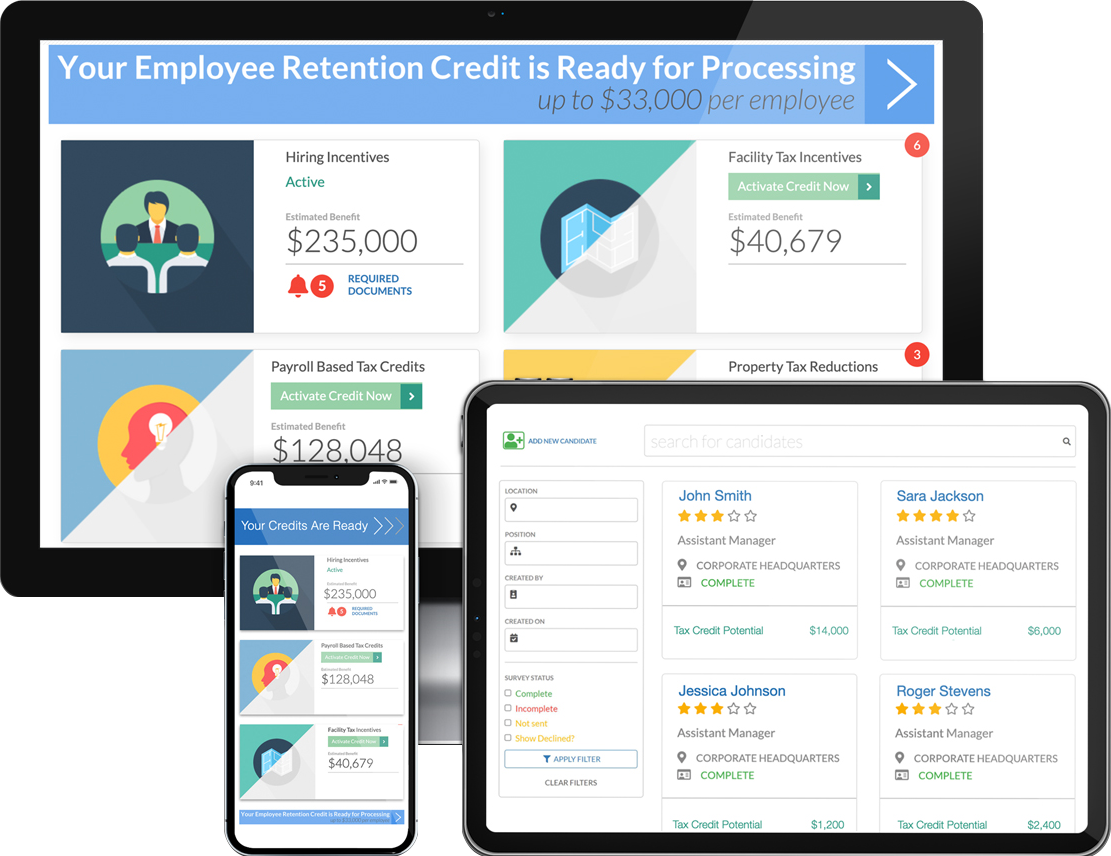

Tax Management System (TMS)

This service has a low monthly fee (starting at $5) that benefits your business in 2 major areas:

- It works with your data to search for all local, state and federal tax incentives that can be applied to your business.

- It simultaneously provides your business with an easy-to-use online platform that helps you and your employees manage day-to-day job activities. The platform:

- Manages and tracks job openings

- Manages and tracks candidates and employees

- Stores resumes and employment documents

- Provides you with HRIS functionality that maintains, manages and processes job, candidate, employee information as well as HR-related tasks, policies and data